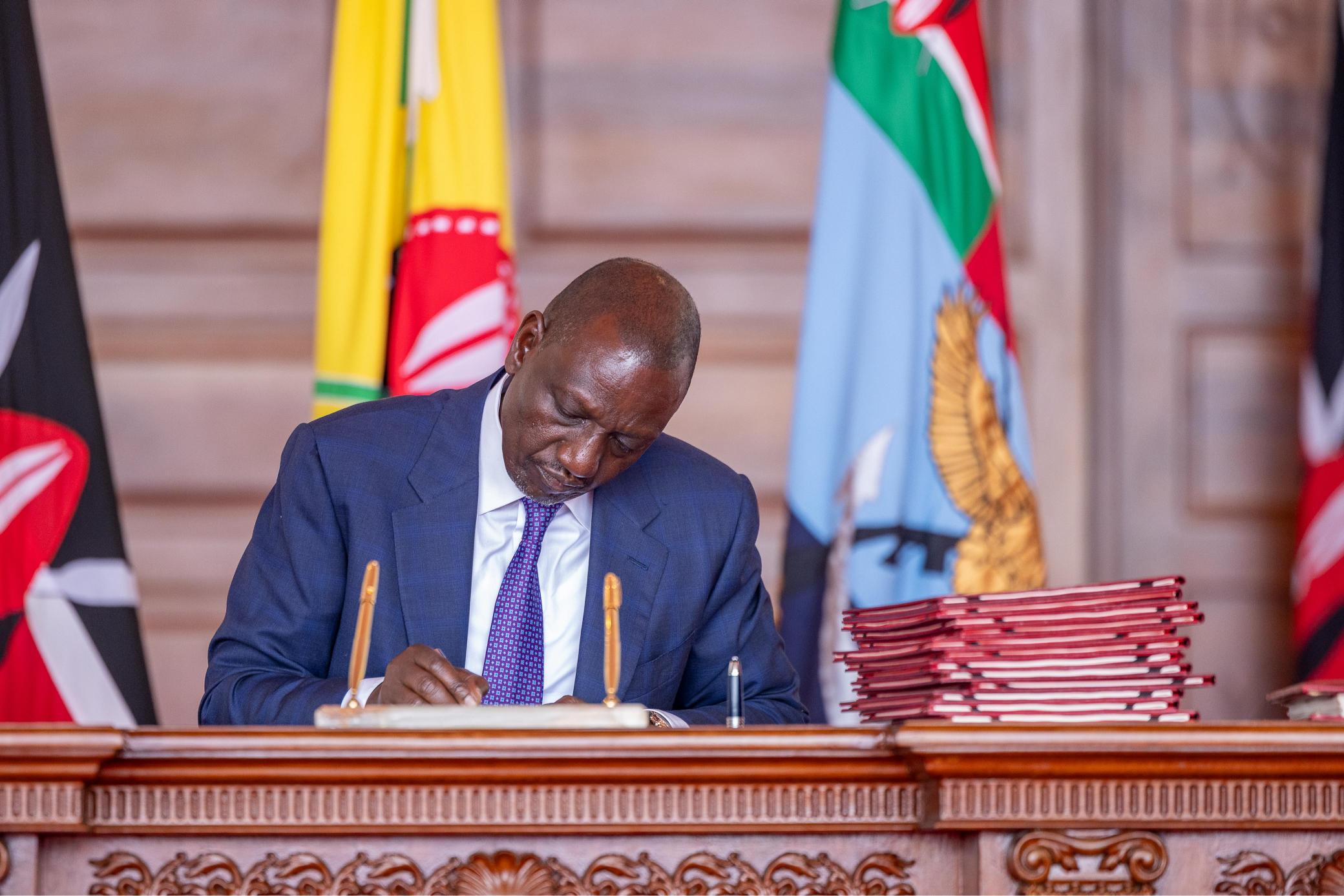

Ruto enacts Finance and Appropriation Acts to fund key sectors

The Finance Act revises six key tax laws, introducing new incentives, exemptions and obligations for businesses, employees, and digital service providers.

President William Ruto has signed into law two critical pieces of legislation, the Finance Act 2025 and the Appropriation Act 2025, paving the way for wide-ranging tax reforms and authorising Sh1.88 trillion in government spending for the 2025/2026 financial year.

The two laws are aimed at expanding revenue sources while investing heavily in agriculture, health, education, and infrastructure to spur growth and improve services.

The Finance Act revises six key tax laws, introducing new incentives, exemptions and obligations for businesses, employees, and digital service providers.

One of the notable changes is that employers will now be required to apply all tax reliefs and exemptions due to their employees automatically. It also increases the daily tax-free subsistence allowance from Sh2,000 to Sh10,000.

In a bid to support long-term savings and retirement, all gratuity and allowances paid under pension schemes will now be exempt from income tax.

Investors in the telecom sector will also benefit from a new allowance for buying spectrum licenses or rights to use fibre optic cables.

The law introduces several changes to promote investment, including the reduction of capital gains tax from 15 percent to 5 percent for certain certified investments of at least Sh3 billion.

Gains from the sale of securities traded on local stock markets and property transfers within Special Economic Zones will also be exempted.

“The Bill provides for exemption from income tax all payments of gratuity and allowances paid under a pension scheme,” the statement reads.

To widen the tax base, the law removes the previous income threshold for the digital services tax, making it applicable to all income earned from providing services online to Kenyans by non-residents.

It also adds new provisions for Advance Pricing Agreements for multinationals and taxes betting winnings at the point of withdrawal.

The controversial Digital Assets Tax has been scrapped and replaced with a 5 percent excise duty on transaction fees charged by virtual asset service providers.

Additionally, a 10 percent excise duty will apply to fees for services related to digital assets.

Under the VAT Act, the law now exempts mosquito repellent and its production inputs, as well as packaging materials for tea and coffee, from VAT to lower costs and promote local industries. The Excise Duty Act introduces a 5 percent tax on deposits into betting, gaming, and lottery wallets and exempts micro-distillers from automation rules to support small producers.

The new law also increases regulation of imports by requiring all importers to present a valid certificate of origin and extends the period for processing tax refunds from 90 to 120 days.

The Appropriation Act allows the National Treasury to spend Sh1.88 trillion from the Consolidated Fund and a further Sh672 billion in revenue collected by state agencies.

Out of this, Sh1.8 trillion is for recurrent expenditure and Sh744.5 billion for development projects.

In the 2025/2026 Budget, agriculture will receive Sh47.6 billion to support fertiliser subsidies, livestock commercialisation, coffee reforms, and blue economy projects.

The law also sets aside Sh18 billion for agro-industrial parks and manufacturing, including textile Special Economic Zones and MSME support.

The health sector has been allocated Sh133.4 billion for UHC, vaccines, hospital infrastructure, and doctor training.

Education receives Sh658.4 billion, with allocations for teacher hiring, university funding, school feeding and free primary and secondary schooling.

To boost connectivity and energy, the government will spend Sh217.3 billion on roads, Sh38.6 billion on ports and air transport, and Sh62.8 billion on energy projects such as rural electrification and geothermal expansion.

Another Sh12.7 billion has been set aside to expand the digital superhighway and support the creative economy.

Together, the Finance and Appropriation Acts mark a major shift in how the government plans to collect and spend public funds, with a focus on innovation, investment and inclusive growth.