Fuliza usage climbs by 800,000 users, disbursements reach Sh982 billion in 2024

According to data from Safaricom, the total number of active Fuliza users reached 7.9 million.

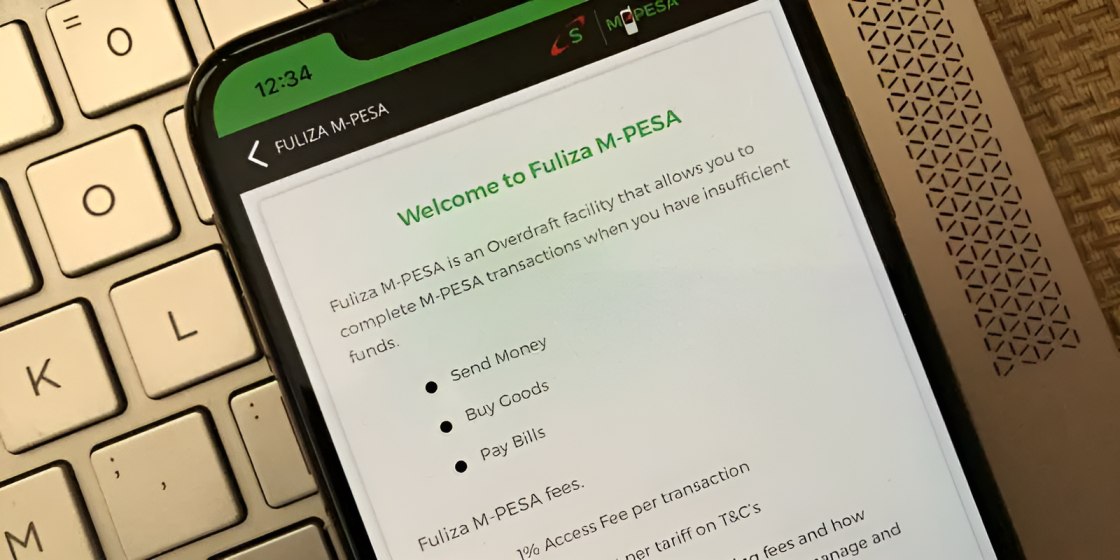

The number of Kenyans using Safaricom’s overdraft facility, Fuliza, surged by 800,000 in the year leading to March 2025, reflecting the increasing financial challenges faced by many households.

According to data from Safaricom, the total number of active Fuliza users reached 7.9 million, marking a 12% increase from 7.1 million the previous year.

This increase in users has led to a substantial rise in the amount of money disbursed through the service, which reached Sh981.6 billion, up from Sh833.8 billion in the previous year.

Consequently, Safaricom’s revenue from the service also grew by 5.6% to Sh4.1 billion, compared to Sh3.9 billion the previous year.

Safaricom attributes this growth in Fuliza usage to the higher credit limits offered, which it believes have driven more people to use the service.

The increase in usage is occurring against a backdrop of rising living costs, job losses, and stagnant wages, pushing more people to rely on short-term credit to cover day-to-day expenses.

The total amount borrowed through Fuliza in the year, which is approximately Sh982 billion, is almost equivalent to the combined allocation for Kenya's education and national security sectors in the 2024/25 national budget.

The education sector was allocated Sh656.6 billion, while the national security sector received Sh373 billion.

Fuliza’s performance has played a significant role in boosting Safaricom’s overall financial results.

The company reported an 11.2% rise in total revenue to $3 billion (Sh388.7 billion) for the financial year, with net income also increasing by 10.8% to Sh69.8 billion.

Following the announcement of these results, Safaricom declared a dividend payout of Sh48.08 billion to shareholders, comprising both final and interim dividends.

Peter Ndegwa, CEO of Safaricom, commented on the company’s performance, saying, "We have delivered excellent group performance with double-digit growth on both the top and bottom lines. This strong set of results reflects the dedication of our teams, the loyalty of our customers, and the strength of our strategy."

The company’s earnings before interest and tax rose by 29.5% to Sh104.1 billion.

In addition to its Kenyan operations, Safaricom’s Ethiopian business contributed nearly 10% of the group’s revenue.

The company expects its Ethiopian operations to move beyond the peak investment phase and become profitable by the 2027 financial year.

In Kenya, service revenue grew by 10.5% to Sh364.3 billion, with M-PESA, which turned 18 last year, contributing Sh161 billion, representing 44.2% of the country’s service revenue.