Mobile money cash transactions fall 12% while user numbers grow

This shift points to a struggling economy where more people are making smaller, low-value transactions.

The value of cash processed by mobile money agents fell by 12.1% to Sh2.04 trillion in the first quarter ending March, even as the number of transactions rose 38.1%.

This shift points to a struggling economy where more people are making smaller, low-value transactions.

Data from the Kenya National Bureau of Statistics shows the cash value handled dropped from Sh2.32 trillion a year earlier, while transaction volume increased from 632.7 million to 873.9 million.

The decline suggests that high-value transactions may be moving away from mobile money agents to other service providers like banks.

While mobile money users once depended on agents to deposit cash, those with bank accounts can now deposit money directly to their mobile wallets.

Low-value transactions under Sh100 have grown in popularity since they are often free of charges, allowing users to avoid fees that range from a few shillings to hundreds.

"Sending money in small amounts of less than Sh100 in multiple transactions helps users avoid paying charges," the data indicates.

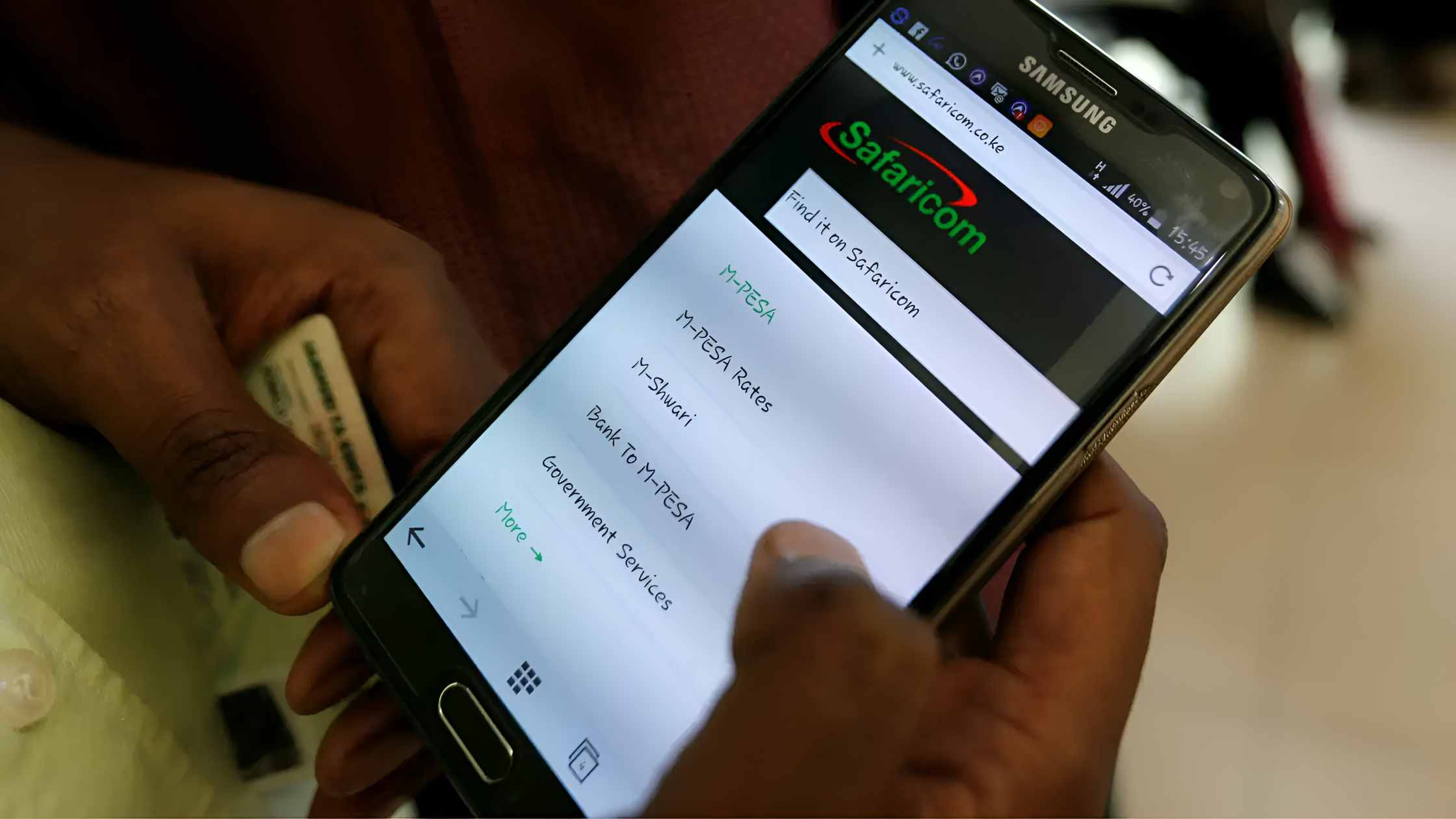

Within the Airtel Money network, transfers are free, but the platform holds a smaller market share compared to Safaricom, which leads with over 90% of mobile money transaction value.

Mobile money subscriptions increased by 7.27 million during the period, reaching 85 million users, while active agents grew by 89,389 to a total of 410,115.

The current drop in cash value reverses a positive trend seen in 2024 when mobile money transactions rose 9.4% to Sh8.7 trillion from Sh7.95 trillion in 2023.

The use of mobile payments surged during the start of the Covid-19 pandemic in March 2020, when charges on low-value transactions were waived to encourage less use of cash and reduce virus spread.

This growth was also supported by Airtel Money removing a rule that required customers to withdraw funds within a week or have them returned to the sender.