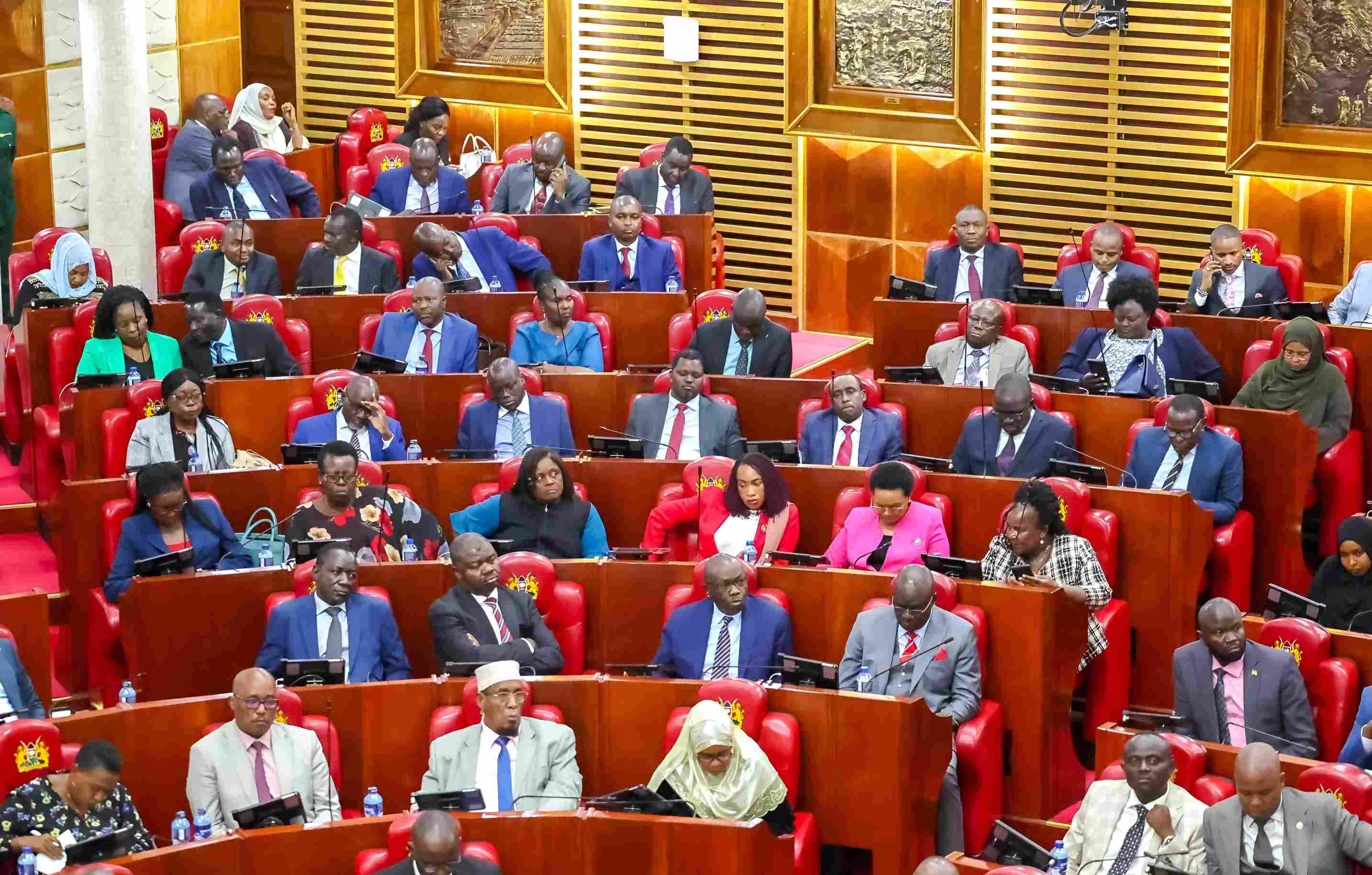

The National Assembly has passed the Finance Bill 2025, clearing the way for new tax measures expected to raise Sh24 billion, but only after dropping some of the most controversial proposals.

The bill now awaits President William Ruto’s assent.

Among the rejected clauses was a proposal by the Kenya Revenue Authority to access private customer data without a court order.

The Finance and Planning Committee, chaired by Molo MP Kimani Kuria, argued the plan violated Article 31 of the Constitution, which protects the right to privacy.

“Section 60 of the Tax Procedures Act already provides sufficient authority for data access through judicial warrants,” the committee said.

MPs also rejected the Treasury’s plan to expand PAYE tax bands to 10 per cent, 17.5 per cent, 25 per cent, 27.5 per cent and 30 per cent, which would have allowed the Treasury Cabinet Secretary to adjust rates by up to 10 per cent every three years.

Another rejected proposal sought to reclassify key items from zero-rated to exempt, which would have increased their cost.

The house instead voted to retain zero-rated status for locally assembled mobile phones, motorcycles, electric bicycles, solar batteries, electric buses, animal feed inputs, and bioethanol vapor stoves.

The House also turned down the move to remove tax incentives for companies engaged in local motor vehicle assembly and construction of at least 100 housing units, safeguarding the 15 per cent corporate tax rate currently applied to them.

Relief was also granted to licensed manufacturers of spirit-based beverages, as MPs retained the Sh500 excise duty per litre on Extra Neutral Alcohol (ENA), shielding the sector from further cost hikes.

To bring clarity to pension taxation, legislators supported a full tax exemption for pension payments—whether paid in lump sum or instalments—and repealed outdated provisions.

The House backed an expanded definition of the Significant Economic Presence Tax (SEPT) to cover websites and electronic networks beyond digital marketplaces, but rejected the proposed Sh5 million threshold, warning it would undermine enforcement and open revenue leak loopholes.