The Kenya Kwanza administration has ruled out introducing any new taxes in the 2026-27 financial year, choosing instead to focus on efficient revenue collection and the privatisation of state corporations.

The announcement is detailed in the Draft 2025 Budget Review and Outlook Paper (BROP) published by the National Treasury on Monday, which sets the blueprint for next year’s budget.

The government plans to improve tax administration, expand the taxpayer base, and simplify tax systems to attract investment and support economic growth.

“Key revenue measures will focus on reducing tax expenditures, expanding the tax base, improving compliance and streamlining tax structures to stimulate investment,” the document reads. Treasury has invited the public to provide feedback on the proposals by Thursday, ahead of Cabinet’s review scheduled for September 30.

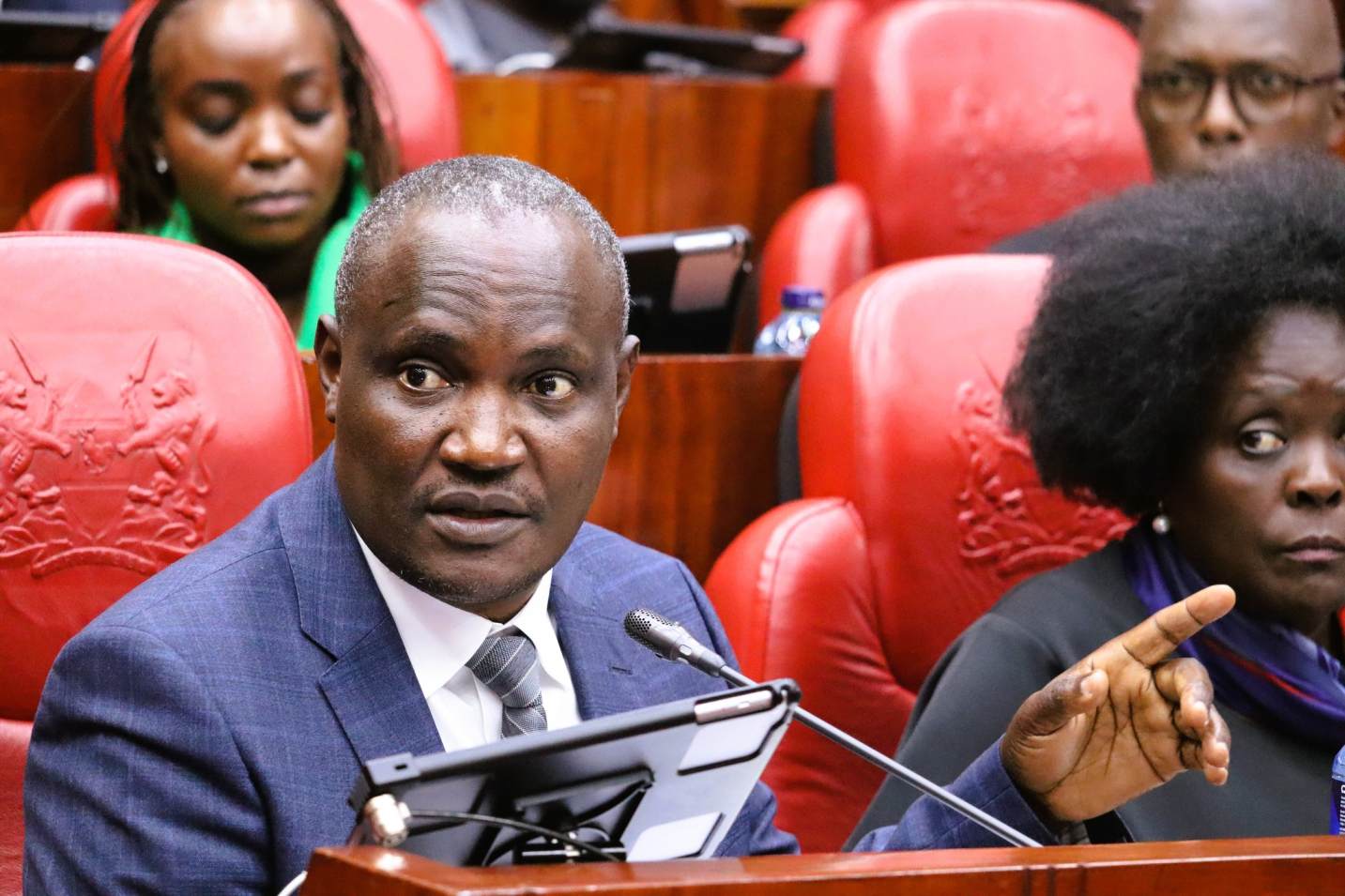

Treasury CS John Mbadi reiterated the government’s stance during an ODM parliamentary group meeting, saying the window for new taxes has closed.

“The option of raising taxes is not available for us. We can only improve the efficiency of the Kenya Revenue Authority,” he said, adding that borrowing is also limited. He pointed to privatisation as a key alternative. “The good thing with privatisation is that it makes the private sector vibrant instead of taking resources from them,” he explained.

In addition to privatisation, the government aims to strengthen revenue collection by improving efficiency and bringing more citizens into the tax system.

The BROP follows disruptions caused by public resistance to the Finance Bill, 2024. It emphasises reducing waste, improving digital platforms, and refining tax rules to stimulate economic activity.

“Simultaneously, public financial management will be strengthened through reengineering of the pension management system, integrated human resource systems, expanded Public-Private Partnerships and governance reforms in state corporations,” the plan says.

Treasury promises stable and predictable tax rates to give businesses and investors the confidence to plan ahead, consistent with the National Tax Policy and the Medium-Term Revenue Strategy.

The government expects to collect Sh3.58 trillion in revenue next year, compared with projected spending of Sh4.64 trillion, leaving a gap of Sh1 trillion to be financed through borrowing.

Plans include borrowing Sh241 billion from international lenders and Sh775 billion from local sources. Revenue is projected to rise by Sh260 billion, lifting its share of GDP to 17.1 per cent, while expenditures grow by Sh350 billion, driven mainly by recurrent costs.

Recurrent spending is set at Sh3,437.2 billion, development expenditure at Sh761 billion, county transfers at Sh446.6 billion, and a Sh5 billion contingency fund. Development allocations will increase by Sh178 billion, highlighting the challenge of balancing growth with rising operational costs.

To manage limited resources effectively, all ministries, departments, and agencies will implement zero-based budgeting. This requires a rigorous review of all current and planned programmes, prioritising those that deliver the greatest impact.

The approach underlines the government’s commitment to disciplined spending, improved governance, and the efficient use of public funds.