How Fuliza gives M-PESA users a lifeline during cash crunch

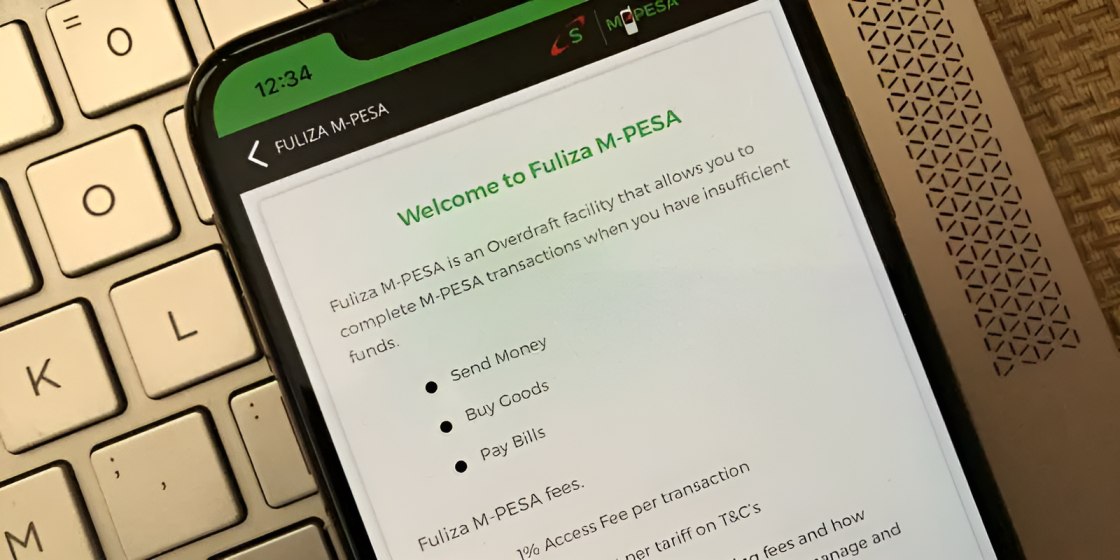

Fuliza is a continuous overdraft facility for M-PESA customers who have insufficient funds to complete transactions.

As more Kenyans turn to mobile loans during emergencies, Fuliza has grown into a leading overdraft service that offers quick relief for M-PESA users with low balances.

Since its introduction in 2019, the product has transformed how people manage short-term cash needs, providing support for daily purchases and bill payments.

How it works

Fuliza is a continuous overdraft facility for M-PESA customers who have insufficient funds to complete transactions.

To use it, one must have an active Safaricom M-PESA line and opt in through the USSD code *334#. Once registered, the user is allocated a loan limit depending on their usage and repayment history.

Fuliza was launched in 2019 through a partnership with KCB and NCBA banks.

While it was originally designed for short-term use between four to seven days, many customers now rely on it for up to two weeks.

The service can be used repeatedly, provided the transaction stays within the assigned limit.

Users can send money, pay bills, buy goods through Lipa Na M-PESA, and purchase airtime using Fuliza.

This flexibility has made the service one of the most accessible and dependable lending tools for many mobile money users.

Eligibility

To activate Fuliza, one must be registered on M-PESA using a national ID, Kenyan passport, or military ID. Foreign passport holders cannot opt into the service.

After opting in, customers are assigned a limit, which determines the maximum amount they can borrow.

New users who have been with Safaricom for less than six months are assigned a zero limit.

However, this can change with time.

The more one uses M-PESA and repays Fuliza on time, the higher the chances of receiving a limit increase.

Users who qualify often receive prompts such as: "You qualify for FULIZA! Dial 334# to check your limit & use FULIZA to complete your M-PESA transactions when you have insufficient M-PESA balance."

Customers also get updates when their limit is raised. A typical message reads: "Dear Xoxoxo, your Fuliza M-PESA limit is KSH 1000.00. Keep using M-PESA to grow your limit."

Repayment

Using Fuliza attracts certain charges. A customer pays a one-time 1% access fee and a daily maintenance fee that starts accruing from midnight of the next day.

While the charges may appear small, extended reliance on Fuliza can lead to accumulated costs.

The service’s popularity is tied to its ability to meet urgent needs at any time, despite the fees.

Its continued use, however, requires responsible borrowing and timely repayment to avoid falling into a debt cycle and to maintain or grow one’s limit.

Fuliza remains a vital tool for many Kenyans navigating tight financial spots.

As one of the most used mobile loan services in the country, its simplicity and wide usability have made it a go-to option for millions seeking fast and flexible financial support.