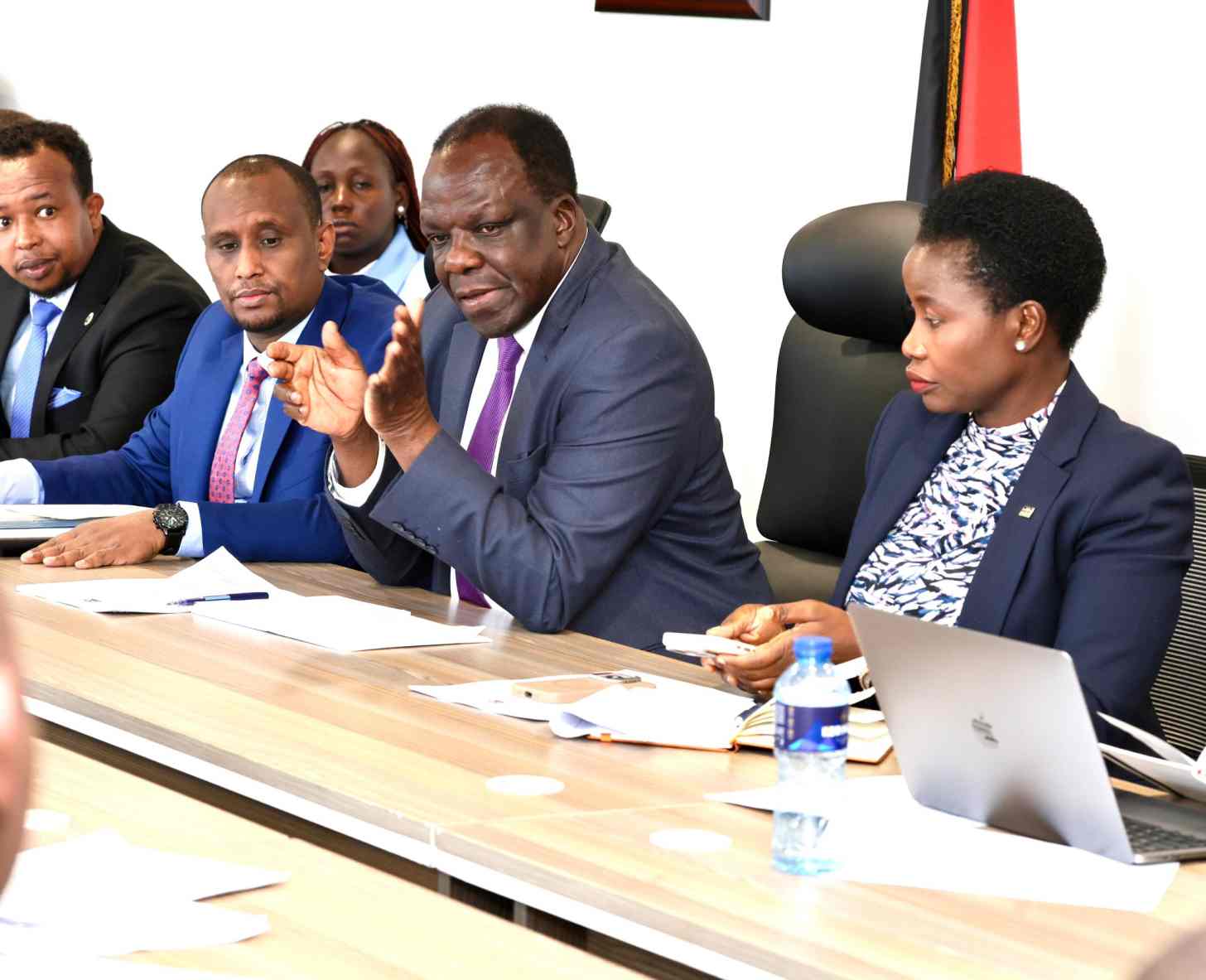

Cooperatives and MSMEs Development Cabinet Secretary Wycliffe Oparanya has pointed a finger at county governments for the financial troubles affecting Savings and Credit Cooperative Societies (Saccos) in Kenya.

While appearing before the Senate on August 6, Oparanya said several Saccos, including Afya Sacco and Moi University Savings and Credit Society (MUSCO), are facing serious liquidity challenges due to delayed remittance of member contributions by devolved units.

He noted that most members of Afya Sacco are medical staff working in counties, yet some administrations continue to withhold deductions running into millions of shillings.

“This is the root cause of the liquidity issues affecting several Saccos,” Oparanya said, adding that the Cooperative Bill currently before the Senate seeks to make such practices punishable by law. He urged lawmakers to back provisions that would hold employers accountable for failing to remit member contributions.

The CS also clarified that the government has no intention of injecting Ksh.500 million into collapsing Saccos due to limited budgetary capacity and instead emphasized the need to empower the Sacco Societies Regulatory Authority (SASRA).

He compared SASRA’s role to that of the Central Bank of Kenya in supervising financial institutions but lamented its weak operational capacity due to underfunding.

“We want SASRA to be strong and self-sustaining,” Oparanya noted, proposing that supervision levies collected from Saccos be retained directly by SASRA, instead of being routed through the National Treasury, a process he says causes unnecessary delays. Treasury CS John Mbadi is reportedly addressing the issue.

Oparanya stressed that reforming Sacco oversight and enforcing remittance laws is key to restoring confidence and sustainability in the cooperative sector.