Why many thought Hustler Fund was a handout - CS Oparanya

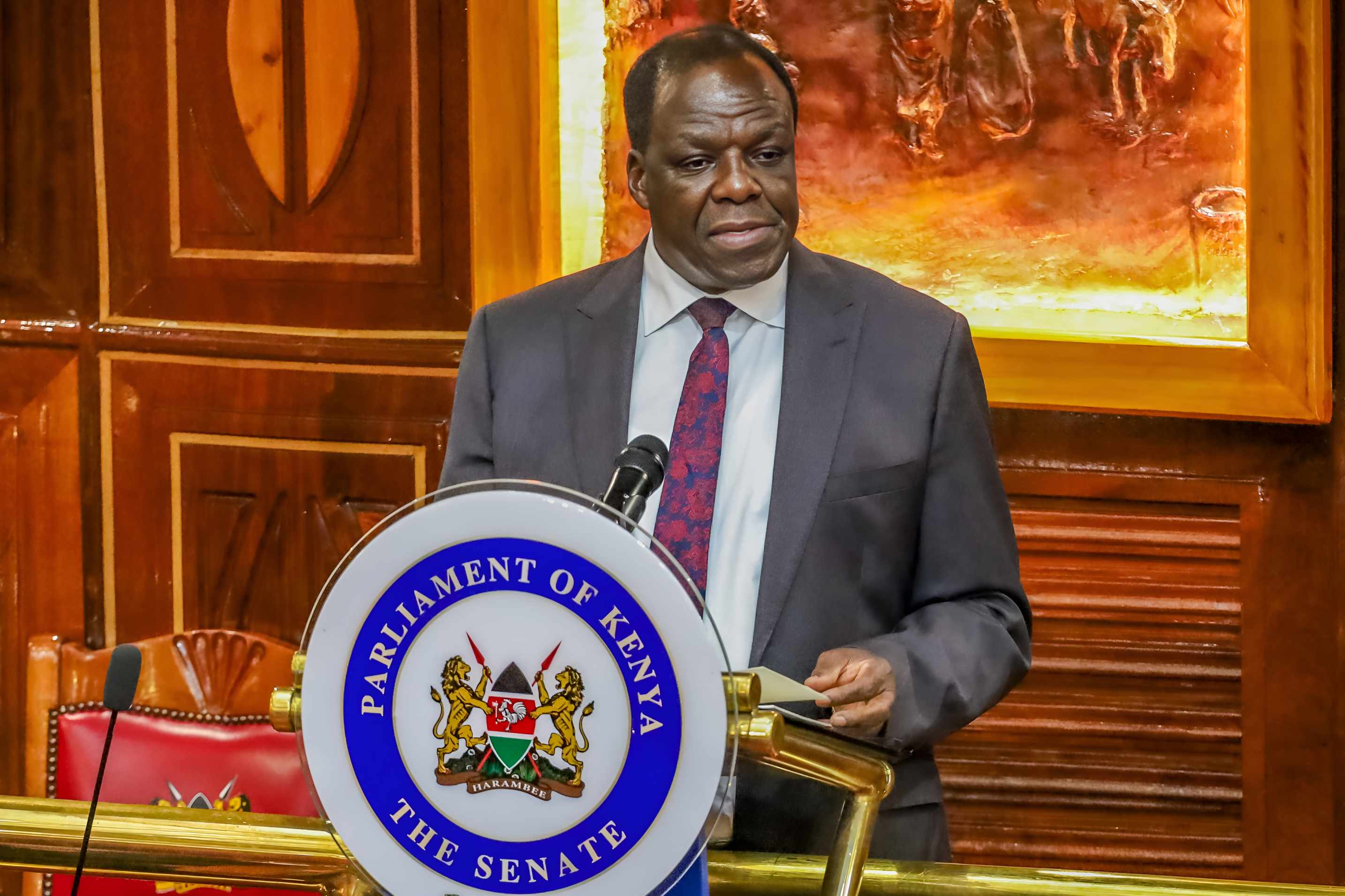

CS Oparanya told the Senate plenary that the fund, launched shortly after the 2022 elections, was mistaken by some borrowers as a reward rather than a loan facility.

The government says widespread misunderstanding of the Hustler Fund's purpose has led to a surge in loan defaults, with many Kenyans viewing the initiative as a political giveaway.

Cooperatives Cabinet Secretary Wycliffe Oparanya told the Senate plenary that the fund, launched shortly after the 2022 elections, was mistaken by some borrowers as a reward rather than a loan facility.

"Unfortunately, when such programmes are introduced after elections, many people assume they are being rewarded. That has contributed to the high number of defaulters," Oparanya said.

The Hustler Fund, officially known as the Financial Inclusion Fund, was designed to offer affordable, digital credit to millions of Kenyans without the need for collateral.

However, more than half of the borrowers have failed to repay their loans, turning over Sh11 billion into bad debt.

"I urge Kenyans who borrowed this money to repay it. This initiative is well-intentioned and meant to benefit many," he added.

The government is now conducting an impact assessment to measure how well the fund is performing. At the same time, a new tracking system is being developed to identify and recover loans from defaulters.

"This is a very important initiative. It’s a joint venture between the Government of Kenya and the World Bank involving Sh33 billion. Already, sensitisation programmes are underway," Oparanya said.

Data from the State Department for Micro, Small, and Medium Enterprises last year showed the default rate had surpassed 50%.

In October, Hustler Fund acting CEO Elizabeth Nkuku told lawmakers that early borrowers had failed to repay even after multiple reminders.

"They are mostly people who borrowed during the first and second months. The default amount stands at about Sh7 billion," she said.

Oparanya noted that despite the challenges, the fund is still making an impact.

Over 25 million Kenyans have accessed more than Sh70 billion through the platform.

Around two million borrowers who have shown repayment discipline have qualified for higher loan limits, up to Sh150,000.

"These borrowers have earned higher limits—up to Sh150,000. The fund is working well and supporting many Kenyans, despite initial challenges," he said.

He urged the public to view the Hustler Fund as a tool for empowerment, not a political handout.

He said its success depends on responsible borrowing and repayment.

"The Hustler Fund credit model is inclusive. It does not require collateral or a credit history," he said.