Brazil turns to China as Trump’s tariffs threaten US coffee trade

The South American nation, which is the world’s largest coffee producer, has been hit with a 50% US import duty, among the steepest imposed by Washington.

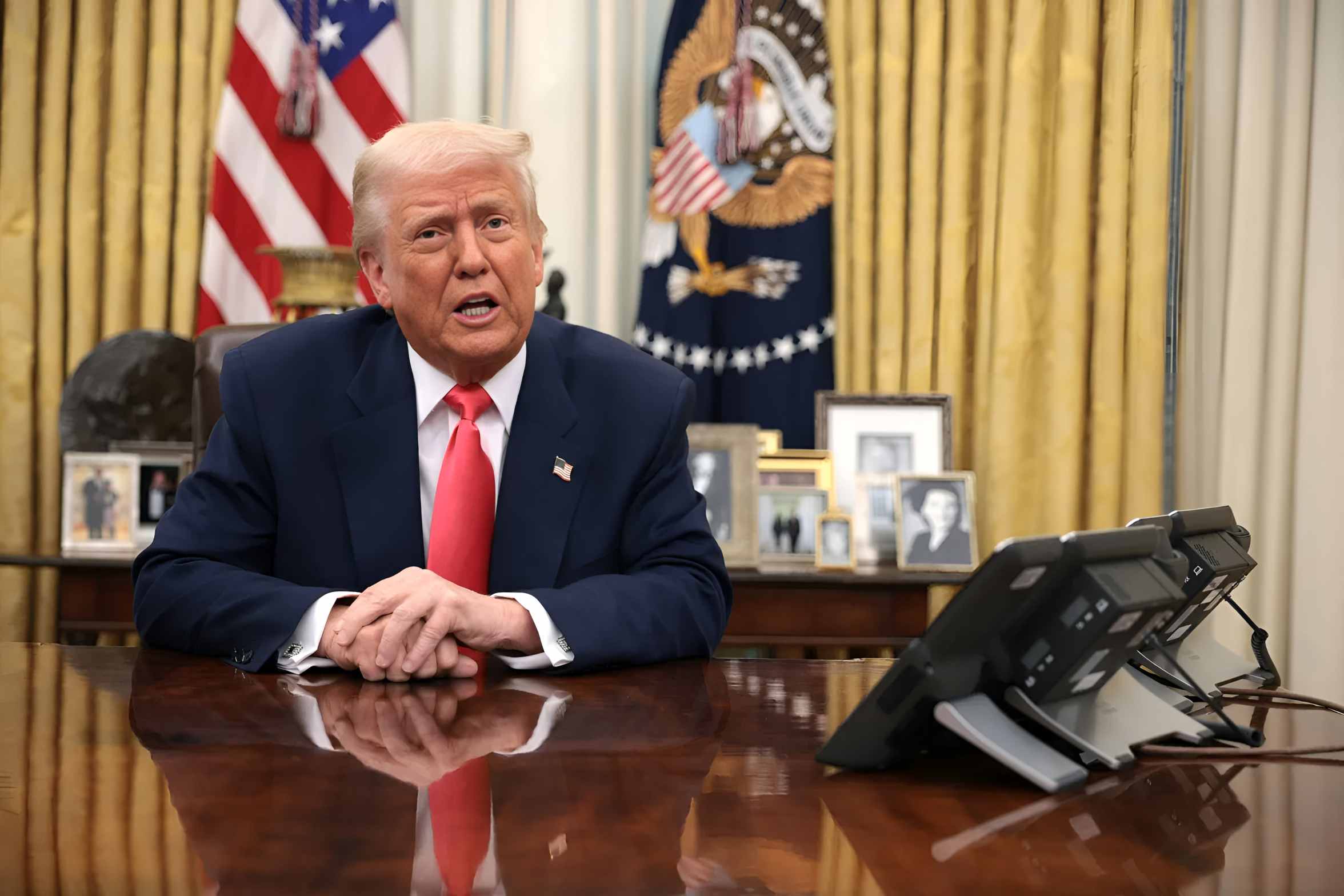

US President Donald Trump has defended his broad tariffs on imports, saying the move will generate jobs, grow the economy, and increase government revenues.

However, trade experts warn that the measures may instead redirect exporters to rival markets like China while pushing up costs for American consumers.

Agricultural brokers told the BBC that exporters from across the world are already exploring opportunities in China, with Brazil emerging as one of the most affected suppliers.

The South American nation, which is the world’s largest coffee producer, has been hit with a 50% US import duty, among the steepest imposed by Washington.

The new tariff threatens Brazil’s foothold in the American market, where it supplies nearly a third of all coffee consumed. Hugo Portes, a supply chain specialist who trades raw coffee beans globally, said China is now becoming an attractive destination.

“If the tariffs are meant to weaken Brazil, in reality, it is pushing sellers closer to China,” he said.

He described the Asian country as “a shining light” for exporters, citing its expanding café culture and vast customer base.

Brazil ships around eight million bags of beans annually to US roasters. But with importers feeling the pinch of higher duties, exporters are urgently seeking alternative buyers.

In July, as the tariffs loomed, more than 180 Brazilian coffee companies registered to sell to China, a move Portes described as “unprecedented” and one that could open the Asian market to even more businesses.

The shift builds on earlier efforts by Brazil’s coffee industry to strengthen ties with China. Last year, producers struck a billion-dollar deal with Luckin Coffee, a fast-growing chain often compared to Starbucks.

Brazilian exporter Fernanda Pizol, who oversees sales at Daterra Coffee, said her company plans to expand shipments to China and other markets if US demand weakens.

“We’ll need to diversify… We already have a waiting list of buyers,” she said. Pizol noted that some American buyers have already paused orders as they gauge the impact of tariffs, while sales in China, Japan, and Europe remain strong.

For US roasters, the new levies could mean higher costs. Coffee consultant Luke Waite estimated that the price of a five-pound (2.2kg) bag of Brazilian beans could climb by about 25% in the coming months.

That increase may translate to café customers paying up to 7% more for a cup of coffee. “It seems small, but these costs add up day-to-day,” he said.