The government’s plan to sell a portion of the Kenya Pipeline Company (KPC) has run into fresh hurdles after lawmakers placed tough new conditions on the transaction.

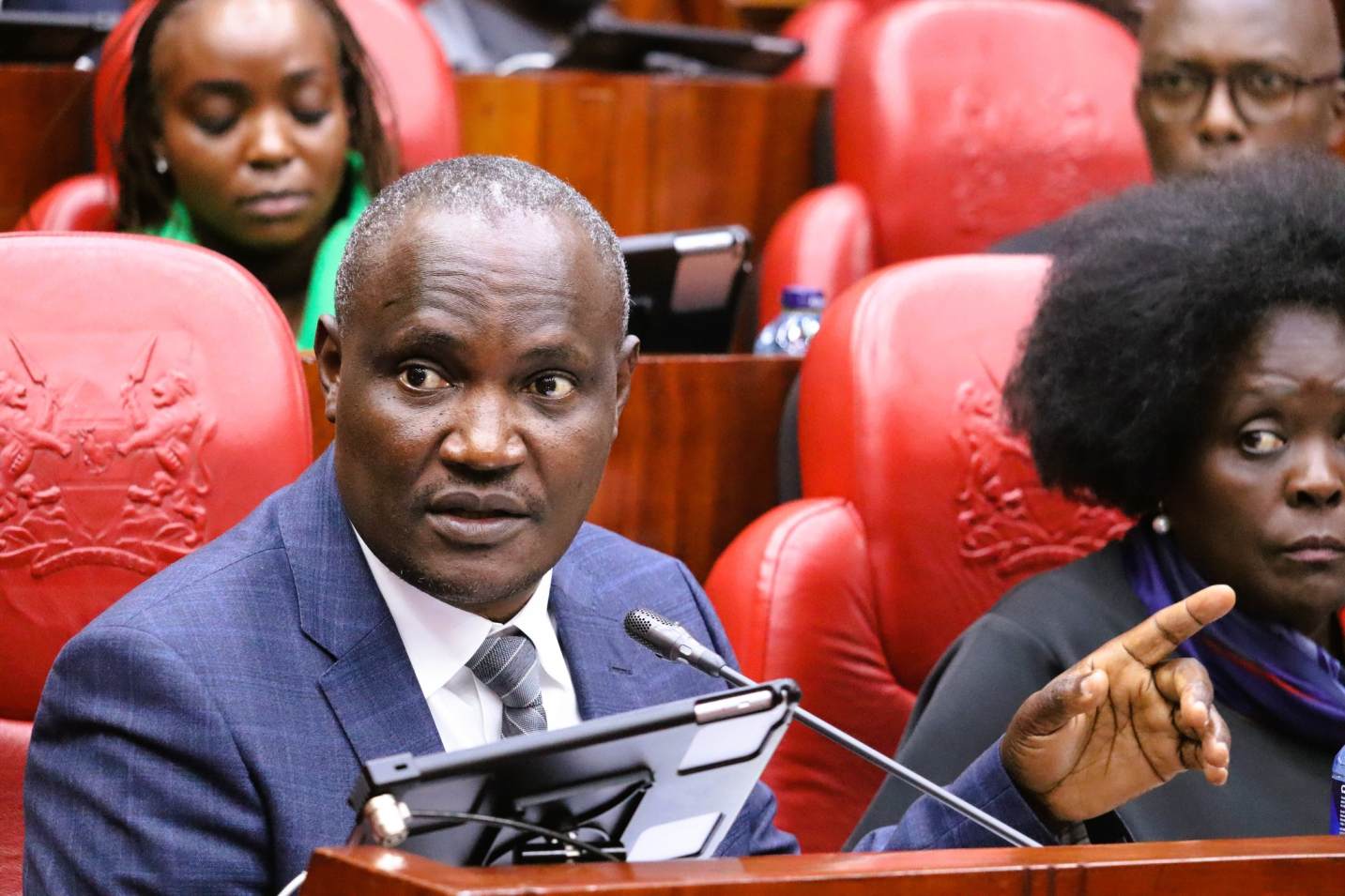

Appearing before the Parliamentary Labour and Social Welfare Committee on Wednesday, Treasury Cabinet Secretary John Mbadi faced mounting concerns from MPs who warned that the privatisation process could expose the country’s energy security to risk if not carefully managed.

Lawmakers resolved that only up to 65 per cent of KPC shares may be floated to the public through the Nairobi Securities Exchange, while the state must retain at least 35 per cent to safeguard control over the strategic asset.

They argued that this measure is necessary to ensure government influence remains intact in a company that oversees the backbone of the country’s petroleum supply.

Beyond ownership structure, MPs demanded strong safeguards to prevent the emergence of a monopoly.

They directed the Privatisation Commission to set a maximum ownership cap for any single shareholder to promote broad-based participation and to protect the market from domination by one entity.

“This House resolves that the Privatisation Commission takes steps to safeguard against excessive concentration of shares in a single entity or related parties and shall set a maximum ownership limit for any one shareholder to help preserve broad-based ownership, promote market competitiveness and protect national and energy security interests,” the Finance Committee report stated.

The report cautioned that an unregulated sale could allow a private player to manipulate petroleum supply and pricing to the detriment of consumers. MPs said they would not allow such an outcome in an industry so central to Kenya’s economic stability.

The lawmakers also raised concerns over the lack of a conclusive valuation of KPC.

They insisted that the government must disclose the company’s true financial position, including its future growth potential, before any transaction can move forward.

“This should also take into account the future potential of the business in compliance with section 31 of the Privatisation Act, 2005,” the report noted.

Another sticking point is KPC’s outstanding financial liabilities.

Legislators flagged pending lawsuits worth Sh5.75 billion as well as Sh3.8 billion in unresolved compensation claims tied to the Thange oil spill in Makueni.

They insisted that these obligations must be fully settled before the company changes hands.

MPs also emphasized the importance of employee welfare.

Despite Energy Cabinet Secretary Opiyo Wandayi’s assurance that no job cuts or restructuring are expected, the committee noted growing anxiety among KPC staff.

To address this, they recommended an Employee Share Ownership Plan to guarantee that workers benefit directly from the privatisation.

Even as these issues remain unresolved, the process now faces uncertainty due to a legal challenge, placing yet another obstacle in the path of the planned sale.