Ruto unveils Sh44 billion market deal to fund landmark Stadium, push economic reform

President Ruto described the Sh44 billion raised as a milestone that affirms Kenya’s ability to tap local markets to finance large-scale projects.

Kenya has taken a major step towards reshaping its financial future with the successful listing of the country’s first-ever infrastructure asset-backed security at the Nairobi Securities Exchange, a move President William Ruto says marks the beginning of a new chapter in sustainable development and economic transformation.

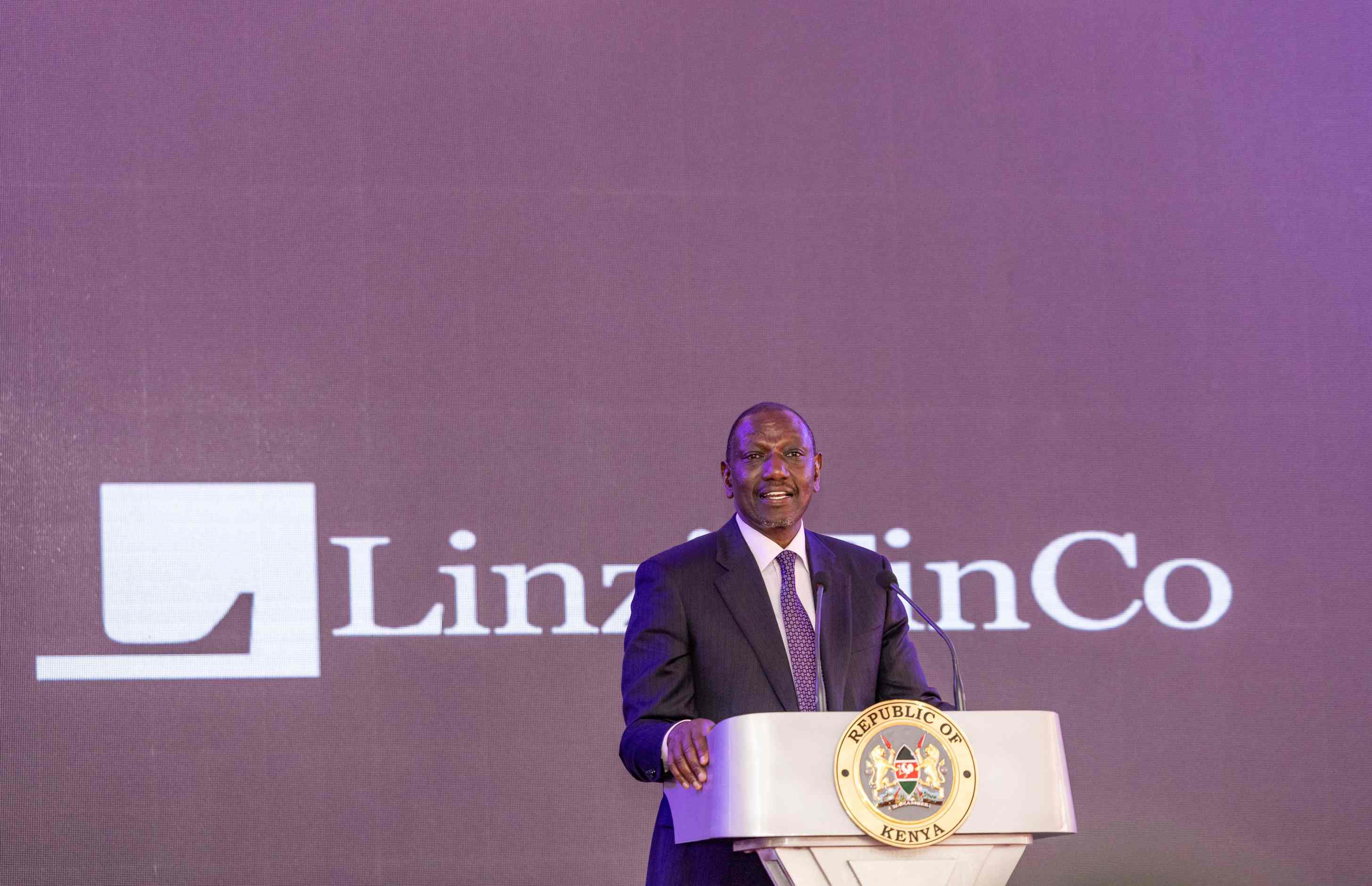

Speaking at the bell-ringing ceremony to mark the listing of the Linzi 003 Infrastructure Asset-Backed Security, President Ruto described the Sh44 billion raised as a milestone that affirms Kenya’s ability to tap local markets to finance large-scale projects.

“This feat joins our G-to-G fuel supply innovation, the first ever asset-backed infrastructure securitisation programme that has raised 175 billion off-balance sheets, and our currency diversification strategy that is gradually reducing our borrowing costs,” he said.

The President said the breakthrough demonstrates the growing sophistication of Kenya’s capital markets and reflects the country’s resolve to reduce reliance on foreign debt.

“Most importantly, it confirms our capacity to mobilise substantial domestic capital to finance strategic national priorities, reduce our reliance on external borrowing, and strengthen Kenya’s economic resilience,” he said.

He announced that proceeds from the listing will go towards the construction of the 60,000-seater Talanta Sports City Stadium — Kenya’s first international-standard stadium built from scratch in more than four decades.

He said the project is not just about bridging a historic gap, but redefining Kenya’s place in global sports.

“This modern, world-class complex is designed to host global tournaments, foster local talent, and restore Kenya’s reputation as a sporting powerhouse,” said Ruto.

President Ruto lauded the Nairobi Securities Exchange for hosting three new listings within one month, attributing the momentum to strong leadership and clear strategy.

He also praised Linzi Finco Trust and its partners for their role in designing the financial product that underpinned the listing.

With the NSE’s market capitalisation now at Sh 2.5 trillion, the Head of State said this recovery signals investor confidence in government reforms, even in the face of difficult choices.

“Some of the choices we have made have not been easy and, at times, not popular. But they have been necessary, strategic, and forward-looking,” he noted.

He cited his recent trip to London where four global firms , Lloyd’s of London, Bupa International, Africa Speciality Risk and Africa Finance Corporation — committed to expanding into the Kenyan market as proof of renewed global interest in the country’s economy.

Ruto announced that the government is finalising plans to list State corporations on the NSE, starting with Kenya Pipeline Company.

“I expect the Cabinet to grant approval for this IPO before the end of the month, after which it will be submitted to the National Assembly for consideration,” he said.

The President added that Kenya is finally ending a decade-long pause on privatisation.

He said the State is now focused on unlocking value, attracting long-term capital, and improving governance through structured and time-bound divestiture.

To further reform public sector participation in capital markets, the National Treasury will soon introduce a disclosure and listing framework requiring Public Interest Entities to make financial data public and eventually list at least 20 percent of their equity at the NSE.

“This reform will promote transparency, improve governance, expand local ownership, and give Kenyans the opportunity to directly participate in our country’s economic success,” he said.

Ruto said these changes are part of broader efforts to deliver on his government’s promises. “The pledges I made to Kenyans are being realised; one by one, day by day, pledge by pledge,” he said, citing progress in health, housing, agriculture, education and job creation.

According to the President, inflation has fallen to 3.8 percent from 9.6 percent, the exchange rate has stabilised at Sh129 to the dollar, and foreign reserves have grown to $11.8 billion.

He added that agricultural production is improving, farmers are earning more, and over 320,000 people are employed in the Affordable Housing Programme across all counties.

He also said 400,000 Kenyans have secured jobs abroad through labour mobility initiatives, while 180,000 others are working in the digital space.

“In the health sector, 110,000 community health promoters are visiting homes, and over 25 million Kenyans are registered under SHA, bringing us closer to universal health coverage,” he said.

The President defended his broad reform agenda, saying it was a deliberate decision to pursue bold change and reject mediocrity. “Yes, I made promises. Yes, I took on many challenges that had bogged down our nation for far too long. This was deliberate and intentional so as to match our leadership with our national ambition,” he said.

He acknowledged that critics may disagree with his approach but asked Kenyans to withhold judgment until the results are clear. “Pause. Reflect. Think. Give me a chance. And judge me fairly when the time comes,” said Ruto.

He concluded by calling on the public to join him in building a better Kenya. “We dream of things that never were and ask, ‘Why not?’”